Identifying the issues and challenges facing participants of the securities settlement lifecycle

Through the SWIFT securities working group, participants and other trusted third-party providers work with SWIFT to provide a cooperative service that utilises APIs to help address industry issues impacting their business operations.

While the securities industry has achieved strong progress on STP rates in the post-trade settlement and reconciliation area over the past decades, securities settlement inefficiencies (including settlement fails) still account for a direct loss of USD ~3 billion every year - an amount that continues to increase despite the CSDR settlement discipline regime penalty scheme that entered into force in February 2022. Some markets have reached higher efficiency rates than others (mainly thanks to local efforts) but the cross-border business can still benefit from a more efficient and smarter settlement processes. And the necessity to reach higher efficiency on a cross-border level is becoming even more paramount as major markets, with high foreign investment attractiveness, are embracing a shorter settlement cycle (T+1). Focusing on cross-border flows, SWIFT embarked in 2019 on a strategic journey to provide its community with better visibility and greater control on their securities settlement transactions through an optional end-to-end two-sided securities tracking service. The service offers API integration channels to support organisations that wish to integrate the service data via a machine connection.

Improving settlement efficiency with securities service.

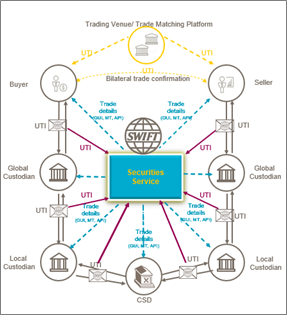

The aim of SWIFT’s Securities service is to bring more efficiency in the post-trade securities settlement life cycle by providing visibility on the end-to-end transaction flow to all parties typically involved in securities settlement.

The consolidation and standardization of bilateral message data enables transaction visibility, consensus, cost reductions and greater interoperability between systems and counterparties. Whilst the service utilizes sender and receiver references, the growing adoption of a unique transaction identifier (UTI) through-out the securities settlement life cycle will allow the service to enable early detection of data discrepancies, drive more accurate workflow decisions and as a result diminish settlement exceptions.

As such the service will reduce the total industry cost of securities trade settlements and help its users to avoid important regulatory penalties and better manage their liquidity & securities.

Solution outline

The securities service will provide visibility and predictability on securities settlement transactions, the same way SWIFT gpi has created an end-to-end view for cross-border payment flows. To do so, it will initially leverage the settlement data carried in the ISO 15022 MT messages, including the use of the UTI which can already be exchanged between counterparties today. A number of matching platforms are capable of generating and/or exchanging a UTI with buyers and sellers. When no matching platform is available, firms can confirm the trade allocation on a bilateral basis, for example via FIX messaging, which also supports the exchange of a UTI. In addition, fields exist in SWIFT settlement messages (ISO15022 and ISO20022) to pass on the UTI through the settlement flow.

The settlement data will be used to power an end-to-end, two-sided, neutral view on a given securities transaction across the chain of participants, providing real-time information on its lifecycle and latest processing status.

Such a view will allow participants to anticipate and prevent settlement fails, thanks to early visibility and comparison mechanisms, and when settlement fails occur, react fast and efficiently to resolve the exceptions hence avoiding or limiting settlement penalties

Users of the securities tracking service will have access to the service data and service functionalities for all settlement transactions & underlying messages in which they have been identified as a party and where the sender, receiver, buyer or seller is a user of the service. This data, and latest status updates to this data, will be provided via the new service to users involved in the transaction over various integration channels (GUI, MT notifications or API notifications).

Organisations that utilize the service subscribe to the service closed user group (CUG) which controls organisations’ access to the service, the service community, and the messages in the service dataset. The SWIFT message types used for securities settlement are consolidated through a shared Unique Transaction Identifier (UTI) value, and/or combination of common sender and receiver entity and message reference values. A consolidated transaction record is created from a source message and is updated by subsequent associated messages from settlement parties acting on either the delivery or receipt side of the settlement process, as well as any additional data submitted by a customer or derived by the service. Through API calls the parties who are part of the transaction can fetch the data. More details including message types and visibility rules are available in the rule book from the service knowledge centre.